The path to be a millionaire is to look at situations differently. The lockdown has seen many people cut down on their investments as incomes have fallen. Is it the right response?

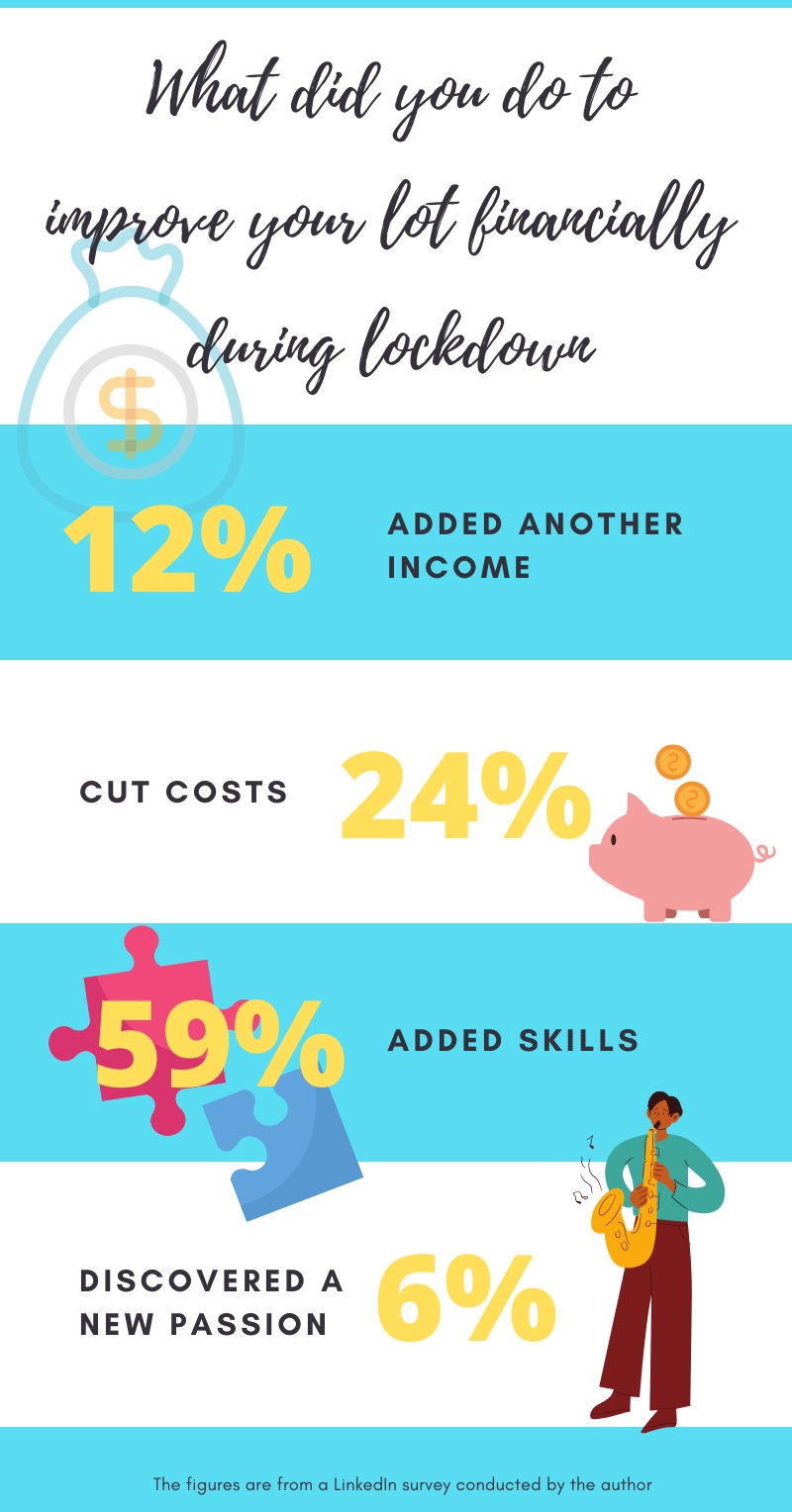

We did a survey on LinkedIn which asked people what they have done to improve their lot financially. Here are the results:

This is the broader reaction to the pandemic of many people across different strata of the world we are in. Is it an adequate reaction? Is it sufficient to maintain the good old life we enjoyed pre-Covid? And going ahead, based on inflationary conditions as goods and services are not produced adequately? The answer is — No. Now you might be thinking of how to plan for it. Some suggestions:

1. Add income generating skills

Given the current economic milieu, the focus is sharply on outcomes. To say that would be an understatement. This is more so if you are an independent professional or an entrepreneur. If you have added to your income generating skills it will show up in your results every month over a period of one to three months, if not, the economic recovery gets delayed for you personally. An example of income generating skills is Digital Marketing from a lead generation point of view. Another is the ability to sell online.

2. Convert a hobby into an income stream

Many of us have left our passions behind while being focused on the daily grind. The lockdown has been a period for us to explore and develop our passions into income streams. For most of us it has been a road less travelled. Some have formed bands with likeminded people, some have written books or ebooks as the case may be, some have taken up organic farming.

3. Build passive income

If you are among the ones who have low debt or zero debt, the fall in income would have been proportional to the fall in expense. However, there is still a gap when it comes to the savings arena. How to bridge the gap?

Let us say, the income was Rs 5 lakhs per month pre-Covid.

- Expenses Rs 2,75,000 (including EMI)

- Tax Rs 1,50,000 rupees

- Savings Rs 75,000

Post-Covid scenario

- Income Rs 3,50,000

- Tax Rs 1,00,000

- Expenses Rs 2,50,000

- Net savings nil

There is a gap of Rs 75,000 rupees per month to be filled. Assuming there are savings in the region of Rs 50 lakh-1 crore, passive income streams to achieve the above results can be created.

What if you are an independent professional or an entrepreneur or working professional looking to retire in the next five years?

For that reality to happen it can be planned gradually. Some of our clients have also looked at liquidating excess real estate over a period of time.

A calm mind with a focused approach is the key to achieve our dreams. Think ahead, be different.